Credit Sesame vs. Credit Karma: Which Is Better for Your Finances?

Choosing a free credit monitoring service can feel overwhelming, but it often comes down to two major players. When comparing Credit Sesame vs. Credit Karma, you're looking at two powerful platforms designed to give you insight into your financial health without charging a fee. Both services offer free credit scores, monitoring, and personalized financial recommendations, but they operate on different models and provide access to different information, which can significantly impact which one is right for you.

This detailed comparison will break down everything you need to know about these services. We'll explore their core features, the type of credit scores they provide, their user experience, and their unique tools to help you make an informed decision. Whether you need a comprehensive view from multiple credit bureaus or are focused on identity theft protection, this guide will clarify the key differences.

Quick Summary

- Best for Comprehensive Free Monitoring: Credit Karma provides free access to your credit scores and reports from two of the three major credit bureaus, Equifax and TransUnion, offering a broader view of your credit profile.

- Best for Free Identity Protection: Credit Sesame's free plan includes a valuable perk: up to $50,000 in identity theft insurance, a feature for which other services often charge.

- Scoring Model Used: Both platforms use the VantageScore 3.0 model. While useful for tracking changes, this is not the FICO score that the majority of lenders use for credit decisions.

- Business Model: Credit Karma is entirely free and makes money through targeted advertising and affiliate commissions. Credit Sesame uses a freemium model, offering a free basic plan and several paid premium tiers with advanced features.

Credit Sesame vs. Credit Karma: At a Glance

This table provides a high-level overview of the key differences between the two platforms, helping you quickly see how they stack up against each other.

| Feature | Credit Karma | Credit Sesame |

|---|---|---|

| Pricing Model | Completely Free | Freemium (Free & Paid Tiers) |

| Credit Bureaus (Free Plan) | TransUnion & Equifax | TransUnion Only |

| Credit Score Model | VantageScore 3.0 | VantageScore 3.0 |

| Credit Reports | Full Reports (TransUnion & Equifax) | Report Summary Only (TransUnion) |

| Score Updates | Weekly (or when changes occur) | Daily |

| Identity Theft Insurance (Free) | None | Up to $50,000 |

| Key Free Tools | Score Simulator, Tax Filing, Auto Hub | Credit Report Card, Borrowing Power Analysis |

| Paid Options | None | Sesame+ (multiple tiers) |

Overview of Credit Sesame and Credit Karma

Before diving into a detailed feature comparison, it's helpful to understand what each company is and how it operates. Both Credit Sesame and Credit Karma were founded with the mission of empowering consumers with free access to their credit information, a service that was once costly and difficult to obtain. However, their approaches and business models have evolved differently over time.

Credit Karma launched in 2007 and quickly became a dominant force in the personal finance space. Its core value proposition is simple: completely free access to credit scores and reports from two major bureaus. The company makes money by analyzing your credit profile and recommending financial products like credit cards and loans that you're likely to qualify for. If you apply and are approved, Credit Karma receives a commission from the lender.

This ad-based model means you never have to pay for its core services.

Credit Sesame, founded in 2010, follows a similar path but with a key difference in its business model. It also provides a free credit score and monitoring service, funded by affiliate recommendations. Where it diverges is with its premium subscription service, Sesame+. This freemium model means that while the basic service is free, users can pay for advanced features like three-bureau credit monitoring, rent reporting to the credit bureaus, and higher levels of identity theft protection.

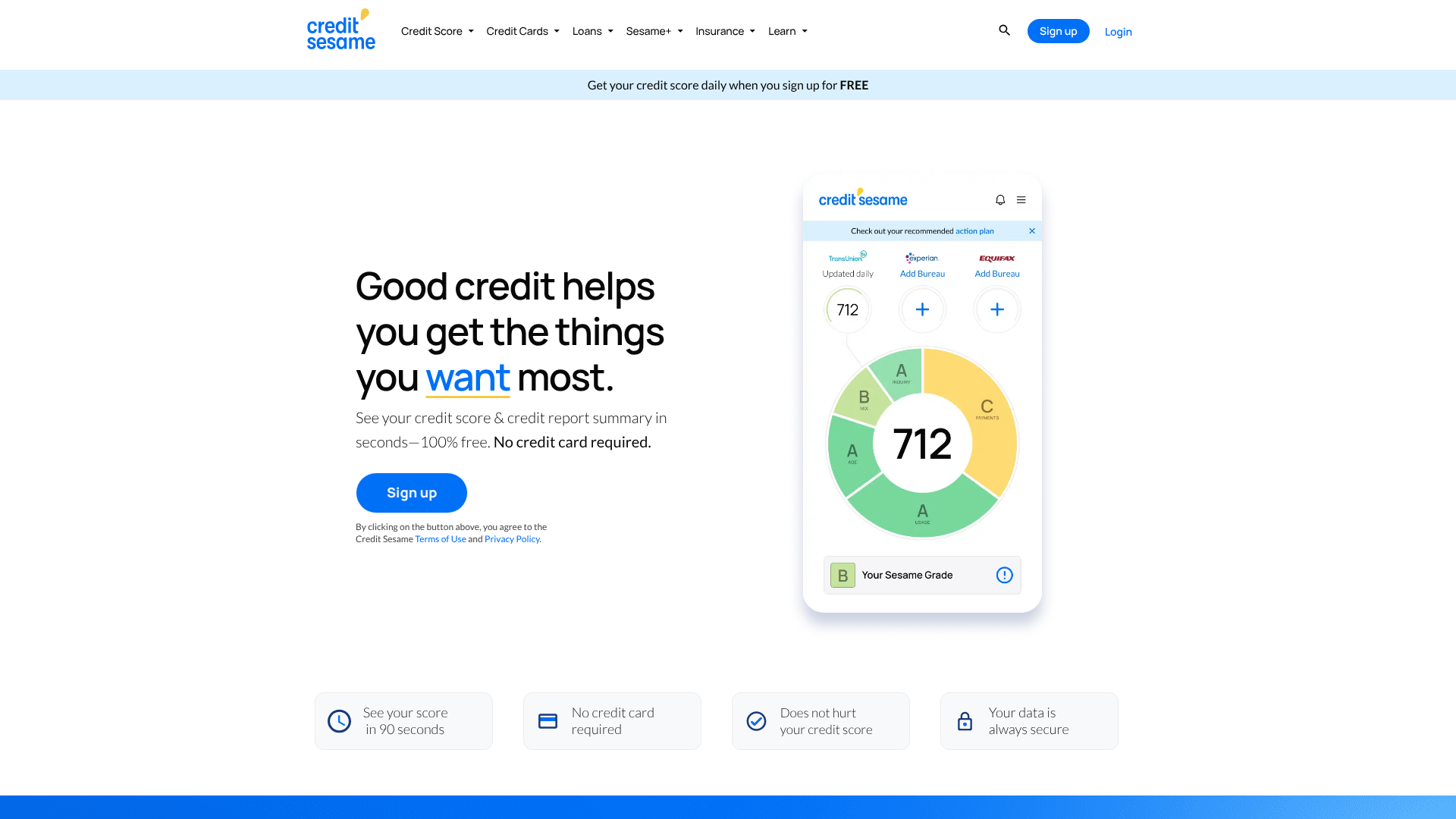

Key Features of Credit Sesame

Credit Sesame packs a lot of value into its free tier, with a strong focus on credit monitoring and identity protection. While it only provides data from one bureau for free, its feature set is designed to give you a solid foundation for managing your financial health.

One of its standout free features is the daily credit score update from TransUnion. This allows you to track changes to your score more frequently than many competitors. The platform also provides a "credit report card," which grades you on the five key factors that influence your score: payment history, credit usage, credit age, account mix, and credit inquiries. This breakdown makes it easy to see where you're doing well and where you need to improve.

The most significant differentiator for Credit Sesame's free plan is the inclusion of up to $50,000 in identity theft insurance and live access to identity restoration specialists. This is a premium feature on most other platforms, and getting it for free provides substantial peace of mind. For users wanting more, Credit Sesame's paid plans unlock three-bureau reports, social security number monitoring, and tools to help build credit, like rent reporting.

Pros

- Free Identity Theft Insurance: The $50,000 policy on the free plan is a major advantage.

- Daily Score Updates: See your TransUnion score refresh every day.

- Credit Report Card: Easily understand the factors impacting your credit score.

- Credit-Building Paid Features: Options like rent reporting can actively help improve your score.

Cons

- Single-Bureau Reporting (Free): The free plan only shows you data from TransUnion, giving an incomplete picture.

- Limited Free Tools: Many of the most powerful tools are locked behind a paywall.

- Fewer Comprehensive Reports: The free version provides more of a summary than a full credit report.

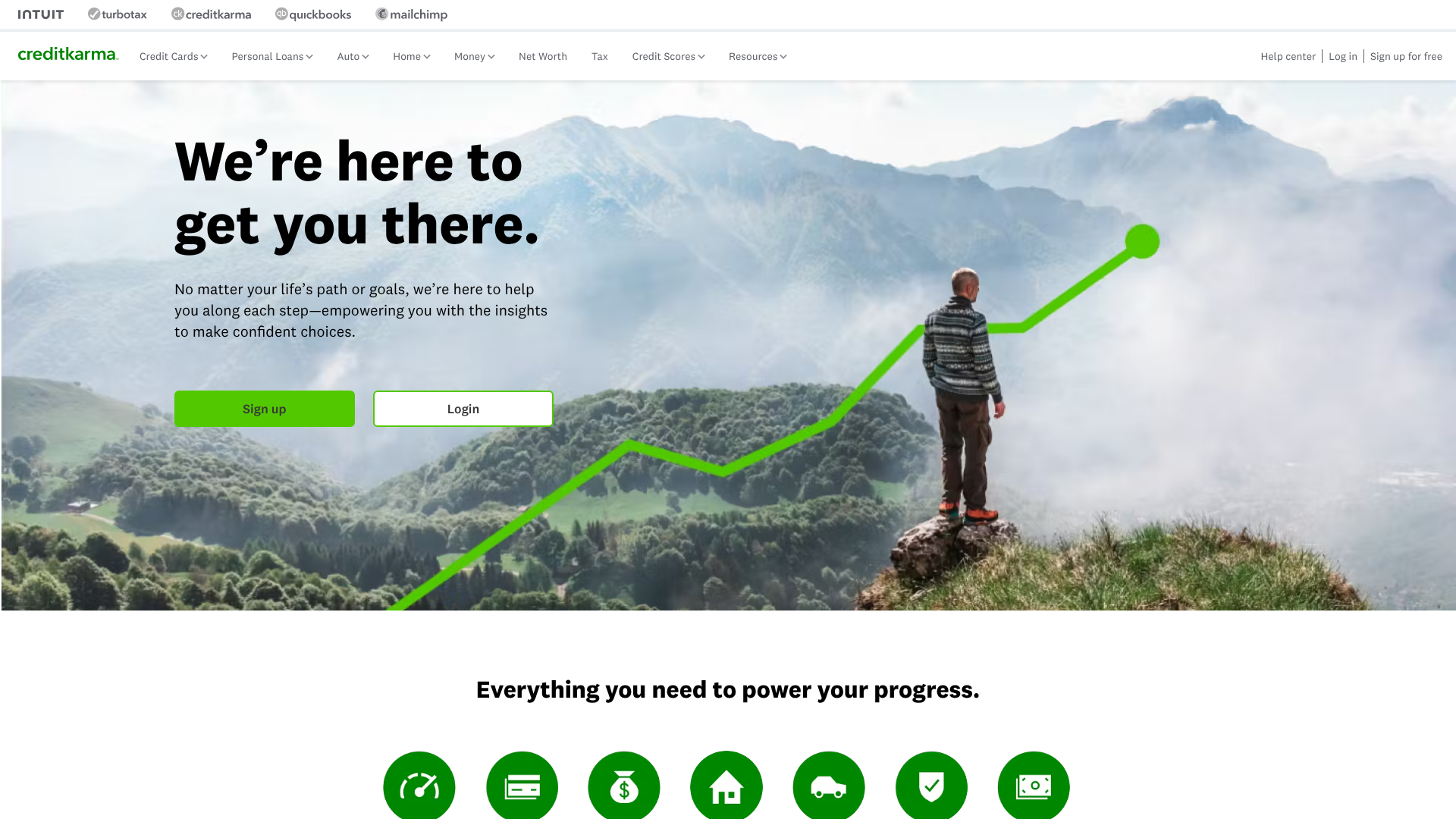

Key Features of Credit Karma

Credit Karma has built its reputation on providing a robust suite of financial tools completely free of charge. Its primary advantage in any credit sesame vs karma comparison is its access to data from two credit bureaus, Equifax and TransUnion. This gives you a more holistic view of your credit, as lenders may report to one, two, or all three bureaus, and your reports can differ between them.

Beyond two-bureau monitoring, Credit Karma offers a powerful credit score simulator. This tool lets you see the potential impact of financial decisions—like paying off a credit card, taking out a loan, or letting an account go to collections—on your credit score. It's an excellent educational resource for understanding cause and effect in the world of credit. The platform also offers free tax preparation and filing services, an auto hub to manage vehicle recalls and value, and an unclaimed money finder that searches state databases for money you might be owed.

Credit Karma Money, a checking and savings account option, is another integrated feature designed to help members manage their finances within one ecosystem. While it doesn't offer free identity theft insurance, it does provide free credit monitoring and will alert you to suspicious activity on your TransUnion and Equifax reports, such as new accounts opened in your name.

Pros

- Two-Bureau Monitoring: Free access to scores and reports from both Equifax and TransUnion.

- Completely Free: No premium tiers or upselling for core features.

- Powerful Free Tools: The credit score simulator is an invaluable educational tool.

- Integrated Financial Services: Free tax filing and banking options add significant value.

Cons

- No Free ID Theft Insurance: Lacks the financial protection offered by Credit Sesame.

- Frequent Product Offers: The platform is heavily supported by ads and recommendations, which some users find intrusive.

- VantageScore Only: Like Credit Sesame, it doesn't provide the FICO scores most lenders use.

Credit Score Monitoring and Reporting

When you're monitoring your credit, the source and type of score you see are critically important. This is one of the most significant areas of difference in the credit sesame vs credit karma debate. Both services provide scores based on the VantageScore 3.0 model, an alternative to the more widely known FICO score. While VantageScore is a legitimate and predictive scoring model, about 90% of top lenders use a version of the FICO score to make lending decisions.

This means the score you see on either app is likely not the exact score your bank will see when you apply for a mortgage or car loan.

So, are the scores useless. Absolutely not. They are excellent directional tools. If your VantageScore 3.0 is going up, your FICO score is likely trending in the same direction.

These scores are best used to track your progress over time and understand how your financial behaviors affect your credit health. The key is not to fixate on the specific three-digit number but on the trends and the underlying factors reported.

The biggest advantage for Credit Karma here is its two-bureau reporting. Your credit reports from Equifax and TransUnion can have different information, as not all creditors report to both. Seeing both reports gives you a more complete picture and allows you to spot errors or discrepancies on either one. Credit Sesame's free plan only gives you access to your TransUnion data, which means you could be missing important information on your Equifax or Experian reports.

Pro Tip: It's a good practice to check your full, official credit reports from all three bureaus—Equifax, Experian, and TransUnion—at least once a year. You can do this for free at AnnualCreditReport.com, the only source authorized by federal law.

User Interface and Experience Comparison

Both Credit Karma and Credit Sesame offer clean, modern interfaces through their websites and mobile apps. They are designed to be user-friendly, even for those who are new to managing their credit. Both platforms use dashboards with charts and graphs to make complex credit information easy to digest at a glance.

Credit Karma's dashboard prominently displays your TransUnion and Equifax credit scores side-by-side, making it easy to compare them. Below your scores, you'll find a summary of your credit factors, such as credit card utilization and payment history. The navigation is straightforward, with clear tabs for your credit reports, financial tools like the simulator, and personalized offers. The app can feel a bit busy with recommendations for credit cards and loans, which is a direct result of its ad-supported business model.

Credit Sesame's interface is similarly clean and focuses on your single TransUnion score. Its dashboard features the "credit report card," which provides a letter grade for each credit factor, a visually intuitive way to understand your strengths and weaknesses. The platform feels slightly less cluttered with ads than Credit Karma, though it still presents offers for financial products. Navigating to your credit details, identity protection features, and premium plan options is simple and direct.

Ultimately, the choice between the two often comes down to personal preference, as both deliver a solid user experience.

Free Services Offered by Each Platform

While both platforms are known for being "free," the scope of their free offerings varies. Understanding what you get without opening your wallet is essential for a fair credit sesame comparison.

Credit Karma's model is built on being 100% free for all its core financial monitoring and management tools. There are no paid tiers or premium features held back. With a free Credit Karma account, you get:

-

Credit scores and full reports from Equifax and TransUnion. – Regular credit monitoring and alerts for both bureaus.

-

The credit score simulator to project score changes. – Free federal and state tax filing. – Access to the Auto Hub for managing vehicle information. – An unclaimed money search tool.

Credit Sesame's free plan is also robust but is designed to work in a freemium ecosystem. The goal is to provide enough value to be useful on its own while encouraging users to upgrade for more powerful features. The standard free plan includes:

-

A daily updated credit score from TransUnion. – A credit report summary (or "report card") from TransUnion.

-

Basic credit monitoring and alerts for your TransUnion report. – Up to $50,000 in identity theft insurance. – Access to personalized financial product recommendations.

Essentially, Credit Karma provides more free credit data (two bureaus vs. one), while Credit Sesame provides more free financial protection (identity theft insurance).

Premium Services and Pricing Models

The business models are a core point of divergence. Credit Karma is entirely free, supported by targeted advertising. You are the product; your anonymized financial profile is used to match you with offers from partners. There is no option to pay to remove ads or unlock features because all features are already available.

Credit Sesame, on the other hand, operates on a freemium model. While its free service is valuable, it heavily promotes its Sesame+ paid subscription plans. These plans are designed for users who want to take a more active role in managing and building their credit. The features and pricing can change, so it's always best to check their website for the most current information.

Typically, the paid tiers include services such as:

- Three-Bureau Monitoring: Get daily or monthly updates on your credit reports and scores from all three major bureaus: TransUnion, Equifax, and Experian.

- Advanced Identity Protection: Higher insurance coverage (up to $1 million), social security number monitoring, and dark web monitoring.

- Credit Building Tools: Some plans offer rent reporting, which adds your on-time rent payments to your credit report to help build your credit history.

- Expert Support: Access to credit experts or restoration specialists to help resolve inaccuracies or fraud.

These premium plans can range in price from around $9.99 to $29.99 per month, depending on the level of service. This makes Credit Sesame a potentially more expensive option if you need the features it places behind its paywall.

Customer Support and Community Engagement

When you're dealing with sensitive financial information, knowing you can get help when you need it is important. However, as is common with many free online services, customer support for both Credit Karma and Credit Sesame can be limited.

Credit Karma primarily directs users to its extensive online help center, which has articles and FAQs covering most common issues. Direct support is available through an email/ticket system, but finding a phone number for live support is difficult. They do not have a public community forum for user-to-user interaction.

Credit Sesame also relies heavily on a digital-first support model. They offer a help center with guides and answers to common questions. For direct assistance, users can contact their support team via email. Like Credit Karma, live phone support is not a prominently featured option, especially for free users.

The overall sentiment from user reviews suggests that customer service for both platforms can be slow and may not always resolve complex issues effectively.

Security and Privacy Measures

Handing over personal information, including your Social Security number, requires a high level of trust. Both Credit Sesame and Credit Karma use bank-level security measures to protect your data. This includes using 128-bit or higher encryption to safeguard your information during transmission and storage. They also employ physical and electronic security protocols to protect their systems from unauthorized access.

One of the most common questions users have is, "Is it safe to give my SSN to Credit Karma or Credit Sesame?" The answer is that it is generally as safe as using any major online financial institution. They require your SSN to verify your identity with the credit bureaus and pull your credit information. Without it, they cannot provide their services.

The main privacy consideration comes down to how they use your data. Both platforms use your financial profile to show you targeted ads for products like credit cards, personal loans, and auto loans. This is the trade-off for receiving their services for free. Credit Karma's business model relies entirely on this, while Credit Sesame uses it to supplement revenue from its premium subscriptions.

It's crucial to read their privacy policies to understand exactly how your data is used and shared with partners.

Best Use Cases for Credit Sesame

Credit Sesame shines for a specific type of user. If your primary goal is to get a basic, no-cost safety net for your identity while keeping an eye on your credit, it's an excellent choice. The free identity theft insurance is a standout feature that provides real financial protection against fraud.

Choose Credit Sesame if:

- Identity theft is your main concern. The free $50,000 insurance policy is the single biggest reason to choose its free plan over competitors.

- You want to actively build credit and are willing to pay. The premium features, especially rent reporting, can be effective tools for those with thin or poor credit files.

- You prefer a simple, streamlined view. For users who find two scores and multiple reports overwhelming, Credit Sesame's single-score dashboard is straightforward and easy to follow.

Best Use Cases for Credit Karma

Credit Karma is the better choice for the data-driven user who wants the most comprehensive free picture of their credit health. It's also ideal for anyone looking for an all-in-one financial hub that goes beyond just credit monitoring.

Choose Credit Karma if:

- You want a more complete view of your credit. Access to both Equifax and TransUnion reports and scores is the platform's biggest strength.

- You want powerful financial tools for free. The credit score simulator is an exceptional educational resource for understanding how credit works.

- You want to consolidate your finances. The free tax filing service can save you over $100 a year compared to paid software, and the other hubs provide value beyond credit monitoring.

Pro Tip: You don't have to choose just one. Many savvy consumers use both services simultaneously. They use Credit Karma for its detailed two-bureau monitoring and tools, and they sign up for Credit Sesame's free plan solely to get the benefit of the free identity theft insurance.

FAQ: Your Questions Answered

Which is better, Credit Sesame or Credit Karma?

Neither is definitively "better"—they are better for different needs. Credit Karma is superior for free, comprehensive credit monitoring because it shows you data from two bureaus. Credit Sesame is better for free identity theft protection, as it includes a $50,000 insurance policy with its basic plan.

Does Credit Sesame give accurate scores?

Credit Sesame provides a real VantageScore 3.0 based on your TransUnion credit data, so in that sense, it is accurate. However, this score may differ from the FICO score that most lenders use for loan decisions. It's best used as a tool to track your credit health over time rather than as an absolute measure of your creditworthiness.

How far off is Credit Karma from your actual score?

Similar to Credit Sesame, Credit Karma's VantageScore 3.0 can be different from your FICO score. The variance can be anywhere from a few points to over 50 points, depending on the scoring model and the data in your credit file. The key is to monitor the trends and the factors influencing your score, not the number itself.

What is the downside of Credit Karma?

The main downsides of Credit Karma are that it uses the VantageScore model instead of FICO, its business model relies on showing you frequent product recommendations, and it does not offer any free identity theft insurance. While its credit monitoring is robust, the lack of financial protection against fraud is a notable gap compared to Credit Sesame.

Is it safe to give SSN to Credit Karma?

Yes, it is generally considered safe. Credit Karma uses bank-level encryption and security protocols to protect your personal information. They require your Social Security number to verify your identity with the credit bureaus, which is a standard and necessary step for any legitimate credit monitoring service.

Conclusion: Making the Final Decision in the Credit Sesame vs. Karma Debate

In the end, the choice between Credit Sesame and Credit Karma depends entirely on your personal financial goals. Both are reputable platforms that have successfully made credit monitoring accessible to millions of people. They empower you with information that was once hidden behind expensive paywalls, helping you understand and improve your financial standing.

If you're looking for the most comprehensive free credit monitoring service available, Credit Karma is the clear winner. With access to two credit bureaus and a suite of powerful, free financial tools, it offers unparalleled insight without ever asking for a payment. If, however, your priority is protecting yourself from identity theft, Credit Sesame's free plan with its included insurance policy offers a unique and valuable benefit.

For the best of both worlds, consider using both platforms. This strategy allows you to leverage Credit Karma's superior monitoring capabilities while benefiting from Credit Sesame's free identity protection. By combining their strengths, you can create a powerful, no-cost system for managing and safeguarding your financial life.